Payment Reminder Best Practices: 7 Brilliant Tips to Improve Your Cashflow

Getting paid on time shouldn't be this hard. But here's a striking fact: 55% of invoices in the US are paid late. And the numbers get worse — 36% of invoices are paid on time, while 9% are written off completely.

Late payments can turn your business's cash flow into a constant headache. But sending payment reminders doesn't have to be complicated or time-consuming. The right approach to accounts receivable can transform how you collect payments and keep your business running smoothly.

Here are seven practical tips that will help you get paid faster and maintain good relationships with your clients.

Late payments can turn a good business relationship sour fast. When customers don't pay on time, it hits your business hard — right in the cash flow. Small businesses spend 14 hours per week chasing late invoices. That's almost two full workdays you could use for something better.

The numbers tell a tough story. 73% of procurement professionals say late payments damage business relationships. And it gets worse — 38% of small businesses close within their first year because of money problems.

Time is your enemy when it comes to collecting payments. After 3 months, there's a 30% chance you'll never see that money. Wait 6 months, and the odds jump to 70%. A year? You're looking at a 90% chance that invoice will go unpaid.

B2B companies are feeling the squeeze. They wait 40.3 days on average to get paid — money that could help grow their business. And for small businesses, payments come in about 8 days after the deadline.

Late payments don't just mess up your books. They create a ripple effect:

These issues can snowball fast. 30% of businesses have thought about downsizing or closing because of late payments. But there's good news — the right payment reminder strategy can help you get paid faster and keep your business relationships strong.

When you're trying to get paid, how you ask matters. 85% of your customers want to pay you on time. They're good clients who might just need a friendly nudge. That's where payment reminders come in.

Payment reminders keep things professional and positive. They're the kind of messages your clients appreciate — clear, helpful, and straightforward. A good payment reminder will:

Sometimes, you've got to be more firm. Dunning letters are what you send when the friendly reminders haven't worked. They're more direct and spell out what happens next:

Here's what's great — by sending effective payment reminders to most of your customers, your A/R team can focus their time on the share of accounts that need more attention. It's a smarter way to work that keeps your cash flow healthy and your client relationships strong.

Here's something interesting: 60% of customers pay on time when they get a good reminder. It's all about making it easy for them to pay you.

Your payment reminder needs to be clear and friendly. Think of it as a helpful message that gives your client everything they need:

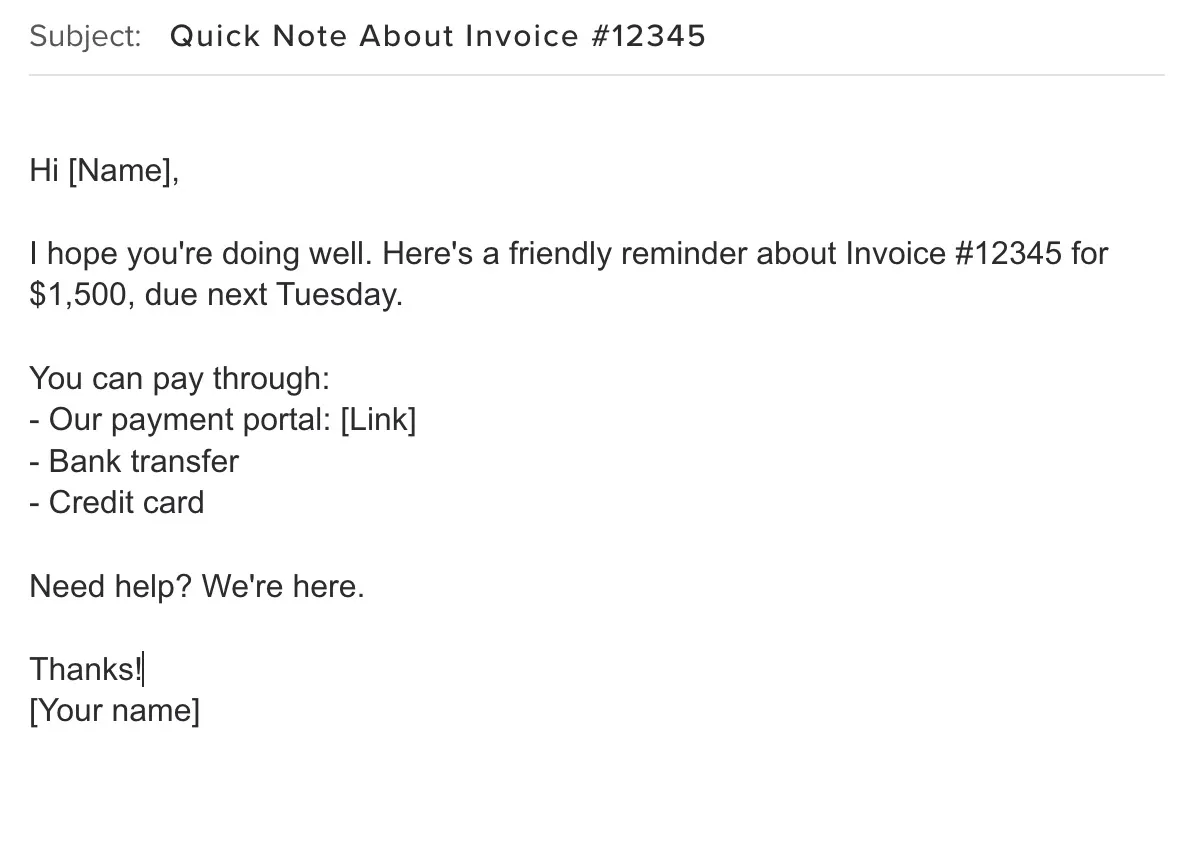

Here's a template that works well:

Send your first reminder 7 days before the due date. A little heads-up goes a long way. Then, if needed, send another on the due date. Keep it friendly — you're helping them stay on track.

Show your clients you're on their side. Answer questions quickly and be flexible when you can. A good relationship makes everything easier.

Don't make your clients guess. Give them:

When you follow up, be helpful:

Let technology do the heavy lifting:

Sometimes clients need a little flexibility:

Good payment reminders do two things: they get you paid faster and they keep your client relationships strong. And that's what matters for your business.

Here's how to create a payment reminder system that works. It's about finding the sweet spot between staying on top of payments and keeping your client relationships strong.

First, map out when you'll send reminders. Your timeline needs to make sense for your business and your clients. A good system tells everyone on your team exactly when to reach out and what to say.

Your email templates should feel personal while getting straight to the point. Include the basics — client name, invoice number, amount, and due date. But add a friendly tone that fits your company's style.

AI tools can do the heavy lifting for you. They'll send reminders right on schedule, track responses, and help your team focus on what matters — building better client relationships.

Your finance team needs to feel confident about the whole process. Show them how the tools work and why timing matters. The more comfortable they are, the better they'll handle client conversations.

Pay attention to what works. Look at how quickly clients respond and when they pay. Use these insights to fine-tune your approach. Sometimes small changes can make a big difference.

Your clients can tell you what works for them. Maybe they prefer texts over emails, or they need more details about payment options. Their feedback can help you make the whole process smoother.

A solid payment reminder process does two important things: it keeps your cash flow healthy and it shows your clients you're organized and professional. That's a combination that helps your business grow.

Getting paid shouldn't feel like a full-time job. The right payment reminder strategy can transform your accounts receivable from a constant worry into a smooth, predictable process. Better yet, it'll help you keep those great client relationships you've worked so hard to build.

Start small. Pick one or two tips from this guide and try them out. You might be surprised how a few simple changes to your payment reminders can make a real difference in your cash flow.

Ready to Make Late Payments a Thing of the Past?

If you're leading a finance team of 5-25 people and spending too much time chasing payments, we should talk. Our AI-powered system can automate your payment reminders while keeping that personal touch your clients appreciate. Let's set up a quick demo and show you how it works with your existing tools like Salesforce or NetSuite.

Book a 30-minute demo with our team — we'll show you how to get your evenings and weekends back while improving your cash flow.

Eliminate manual bottlenecks, resolve aging invoices faster, and empower your team with AI-driven automation that’s designed for enterprise-scale accounts receivable challenges.